Digital payments have become the backbone of modern commerce. Entrepreneurs, freelancers, and small businesses are moving toward platforms that simplify transactions, improve customer convenience, and offer secure ways to receive money. One such option is a Cash App Business Account, which in 2025 continues to stand out as a practical solution for those who want fast, reliable, and professional digital payments.

In this guide, we’ll walk step by step through how to set up a Cash App Business Account in 2025, explore its features, benefits, requirements, and how it can help grow your business.

What is a Cash App Business Account?

A Cash App Business Account is a digital payment account designed specifically for entrepreneurs, freelancers, and organizations to accept payments from customers in a professional manner. Unlike a personal account, which is typically used for peer-to-peer transfers, a business account allows you to:

- Accept unlimited payments.

- Provide customers with receipts.

- Separate business and personal finances.

- Gain access to transaction records for accounting purposes.

In 2025, as cashless transactions dominate the global market, having a Cash App Business Account is no longer optional—it’s an essential tool for business growth.

Why Use a Cash App Business Account in 2025?

Before diving into the setup process, let’s explore why so many entrepreneurs are opting for this account type:

- Professionalism: Customers trust businesses that use verified payment systems.

- Faster Payments: Instant transfers reduce waiting times.

- Lower Barriers: No need for complex banking setups to start receiving money.

- Global Readiness: More features in 2025 now support cross-border payments and invoicing.

- Ease of Use: Both businesses and customers enjoy a simplified payment process.

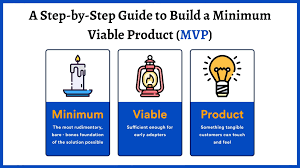

Step-by-Step Guide: How to Set Up a Cash App Business Account in 2025

Setting up an account is straightforward, but doing it correctly ensures you maximize its potential. Here are the 10 detailed steps you should follow:

Step 1: Download and Install the App

The first step is to download the official application from your device’s app marketplace. Once installed, open the app and sign up using your phone number or email address. You will receive a verification code to confirm your identity.

Step 2: Choose Between Personal or Business Account

During the registration process, you’ll be prompted to select your account type. Here, you must choose Business Account. This ensures that your profile is set up to accept payments for goods and services.

If you already have a personal account, don’t worry—you can easily switch to a business profile within the settings section.

Step 3: Enter Your Business Information

Provide accurate details such as:

- Business name.

- Contact number.

- Physical or registered address.

- Type of business (retail, services, freelance, etc.).

These details will be visible to customers, so make sure they are professional and consistent with your branding.

Step 4: Verify Your Identity

To comply with financial regulations in 2025, identity verification is mandatory. You’ll be asked to provide:

- Full legal name.

- Date of birth.

- Social identification details (depending on your country).

- A photo of a government-issued ID.

Verification ensures your account is secure and protects your customers.

Step 5: Link Your Bank Account

For transferring earnings, you must link your Cash App Business Account to your bank account. This allows smooth withdrawal of funds. You can also link a debit card for faster access.

Many users in 2025 prefer enabling instant transfers, although standard transfers remain free.

Step 6: Customize Your Business Profile

Personalize your account with:

- A branded profile picture or logo.

- A custom $Cashtag (your unique payment ID).

- A business description so customers know what you offer.

This not only builds credibility but also makes it easier for customers to identify your business.

Step 7: Enable Business Features

In 2025, the business account offers advanced tools such as:

- Automatic digital receipts.

- Payment request links you can share via email, SMS, or social media.

- Customizable invoices.

- Integration with accounting tools.

Turn on these features in your settings to maximize your account’s potential.

Step 8: Set Up Payment Options

You can accept payments through:

- QR codes generated by your account.

- Direct payments via your $Cashtag.

- Payment links that customers can click to pay instantly.

Offering multiple options ensures convenience for your audience.

Step 9: Test Your Account

Before going live, run a few test transactions. This will confirm that:

- Your account is receiving payments.

- Notifications and receipts are working properly.

- Funds are transferring smoothly to your bank.

Testing helps avoid issues once you begin operating at full scale.

Step 10: Launch Your Business with Cash App Payments

Now that your account is fully set up, you can share your payment details with customers. Add your $Cashtag or QR codes to invoices, websites, or promotional materials. Train your staff (if applicable) on how to handle transactions.

Benefits of a Cash App Business Account in 2025

Once your account is running, you’ll enjoy several advantages:

- Unlimited Transactions – No limits on the number of payments you can receive.

- Instant Settlements – Faster than traditional bank transfers.

- Professional Receipts – Customers receive instant confirmation.

- Record Keeping – Automatic logs help with bookkeeping and taxes.

- Customer Trust – A verified business account enhances credibility.

Fees and Pricing

In 2025, the platform charges a small processing fee for business transactions. While personal transfers may remain free, business accounts incur a transaction fee (for example, around 2.5–3%).

Although this adds to your expenses, it ensures smooth services, faster payments, and enhanced customer support.

Best Practices for Using Your Cash App Business Account

- Maintain Professionalism: Use a clear business name and logo.

- Separate Finances: Avoid mixing personal and business transactions.

- Ensure Security: Enable two-factor authentication and monitor activity regularly.

- Provide Transparency: Always issue receipts and maintain clear policies.

- Keep Records: Download monthly statements for tax and accounting purposes.

Common Mistakes to Avoid

- Using a personal account for business transactions (this may violate terms).

- Not verifying your identity, which can delay transfers.

- Ignoring customer support queries.

- Failing to update banking details promptly.

- Overlooking small transaction fees in pricing calculations.

By avoiding these errors, you can ensure smooth operations.

The Future of Digital Business Payments in 2025

As we move further into the digital economy, payment apps are evolving rapidly. In 2025, features such as AI-driven fraud prevention, smart invoicing, and instant cross-border transactions are redefining how businesses handle money.

A Cash App Business Account puts you at the forefront of this transformation, giving your business the tools it needs to remain competitive in an increasingly cashless world.

Conclusion

Setting up a Cash App Business Account in 2025 is one of the smartest decisions an entrepreneur can make. It not only simplifies transactions but also enhances professionalism, builds trust, and ensures faster, more secure payments.

By following the 10-step process—researching, verifying, linking your bank, enabling features, and launching—you can position your business for success in the digital-first economy.For those who want expert guidance in digital transformation, app integration, or scaling online business systems, many entrepreneurs rely on the expertise of Findthecoder, a trusted partner in building seamless and future-ready solutions.